Options spread implies heavy short build-up

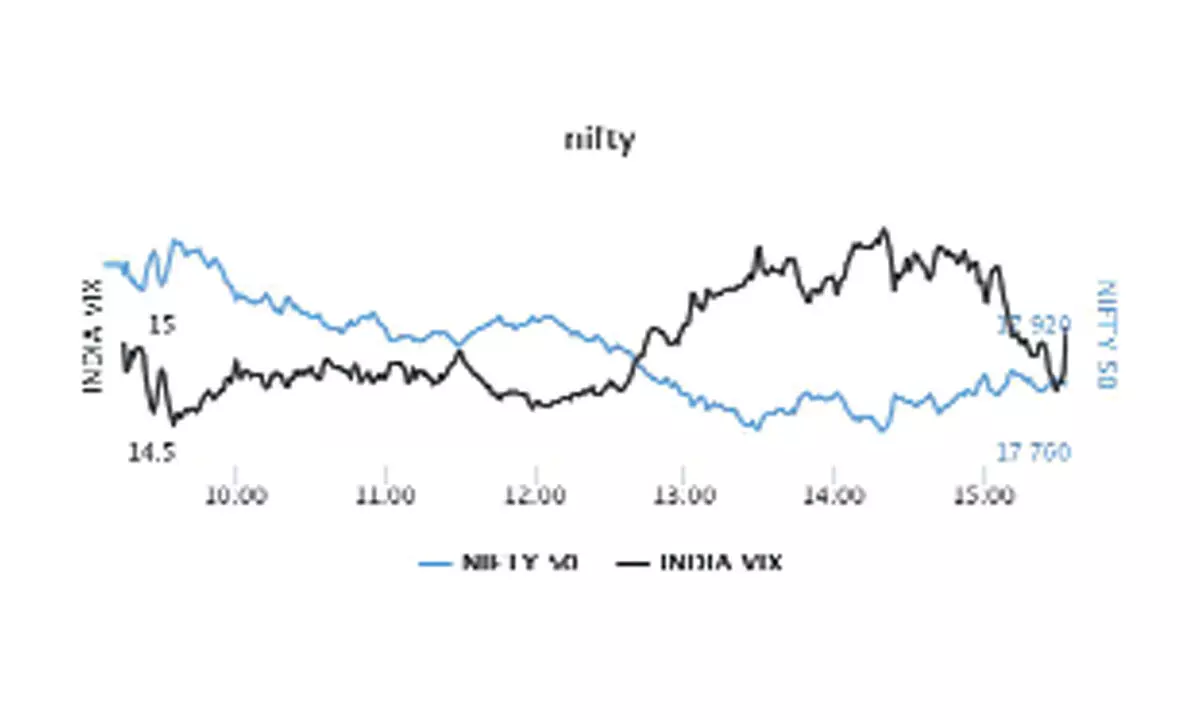

India VIX rises by 0.28% to 15.02 level suggesting marginal declines this week; FIIs turned sellers in stock Futures, while they have been net buyers in index Options segment

image for illustrative purpose

The resistance level declined by 200 points and support level moved up by 500 points as the highest OI bases on Call and Put strikes concentrated at 18,000 strike after the last Friday session. The current OI spread indicates strong range-bound movement in NSE Nifty for the week ahead.

The 18,000CE has highest Call OI followed by 18,100/ 18,200/18,300/ 18,600/ 19,000/ 19,500 strikes, while 18,000/18,100/ 18,600/19,000 strikes recorded significant build-up of Call OI.

Coming to the Put side, maximum Put OI is seen at 18,000PE, followed by 17,900/17,700 /17,00/17,300 /17,500 strikes. Further, 17,900/17,800 /17,600 /17,500/17,350 strikes recorded a reasonable addition of Put OI.

NSE Nifty during the later part of the last week recorded an aggressive short build-up as Nifty near month OI rose by 15 lakh shares. Moreover, aggressive Call writing positions are seen at ATM Call strikes with 18000 Call holding more than 1.5 crore shares for the coming weekly expiry. Analysts predict that closure of these positions may result in a meaningful recovery.

Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd, said: "From derivatives front, hefty Call writing was observed at 18,000 strike, while Put writers remained on the back foot with marginal Open Interest seen at 17800 strike."

Technology stocks are expected to witness heavy trading due to their upcoming results this week. Infosys recorded some aggressive short build-up in both Futures and options last week. Hence, a move above 1500 may trigger a short covering move in the stock. However, rest of the stocks have not seen any major Futures activity, as per data from ICICIdirect.com.

"Indian markets witnessed heavy sell off in the week gone by as investor risk sentiment took a blow post the release of the FOMC meeting minutes, which indicated further rate hikes in 2023," added Bisht.

BSE Sensex closed the week ended January 6, 2023, at 59,900.37 points, a heavy fall of 940.37 points or 1.54 per cent, from the previous week's closing of 60,840.74 points. NSE Nifty ended the week at 17,859.45 points, further lower by 245.85 points or 1.43 per cent, from 18,105.30 points a week ago.

Bisht forecasts: "Technically both the indices can be seen trading with formation of lower bottom pattern and likely to remain under pressure in upcoming week as well. For Nifty, the 17,700 level would act as an immediate support below, which further selling pressure can be seen and this may move the index towards 17500 as well. Traders are advised to remain cautious as markets are expected to remain highly volatile in the upcoming week."

India VIX rose marginally by 0.28 per cent to 15.02 level. Despite weakness in the market, the volatility index India VIX has not moved much and is still around 15 level suggesting expectation of limited declines, but a move below the recent low of 17750 may trigger a rise in volatility. Hence, derivatives analysts advise to avoid longs below these levels.

"Implied Volatility (IV) of Calls closed at 13.39 per cent, while that for Put options closed at 14.38 per cent. The Nifty VIX for the week closed at 14.98 per cent. PCR of OI for the week closed at 1.29," said Bisht.

FII activity in the F&O space concentrated on the Index Futures segment. While NSE Nifty moved back towards 17,800 level, FIIs remained on net shorts as they sold another Rs3,800 crore in Index Futures. At the same time, they turned sellers in the stock Futures segment by Rs800 crore, while their net longs declined from nearly 75,000 contracts to 60,000 contracts. Major action was seen in the index Options segment where they have been net buyers of Rs25,800 crore during the week.

Bank Nifty

NSE's banking index closed the week at 42,188.80 points, lower by 797.65 points or 1.85 per cent, from the previous week's closing of 42,986.45 points.

Despite selling last week, OTM Put additions continued in Bank Nifty. Major activity is seen at the ATM strikes and it's triggering more volatility. Intermediate support for the Bank Nifty is now placed at December series low near 41500 levels.